Silver Market Insights: Analysis & Trends

Silver Market Insights: Analysis & Trends

Despite gold reaching record levels in 2024 and the first two months of 2025, silver continues to enjoy success in the industrial sector.

Ahead of the publication of the World Silver Survey by Metals Focus, scheduled for April 16th, we seek to analyze demand and development prospects for the white metal.

In fact, forecasts indicate a silver market deficit in 2025, marking the fifth consecutive year.

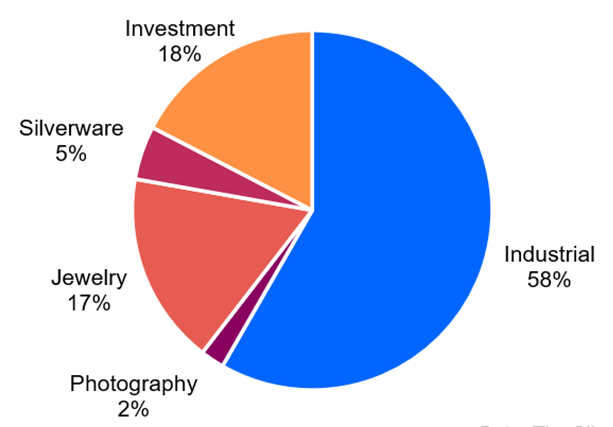

Industry as a key driver of demand

Global silver demand in 2025 is expected to remain stable at 1.20 billion ounces, as increased demand from the industrial sector and retail investment is offset by a weakening in jewelry.

Industrial silver production is expected to grow by 3% over the year, with volumes set to exceed 700 million ounces for the first time.

Although the green sector has traditionally been a key driver supporting silver demand, it is expected that the new US president Donald Trump will block investments for the development of renewable sources, aiming instead for fossil fuels. However, US policies opposing climate action should not prevent the photovoltaic industry from reaching an all-time high in 2025, thus benefiting demand for the precious metal.

The automotive industry also contributes significantly, introducing increasingly sophisticated vehicles onto the market and continuing to invest in the expansion of infrastructure related to the sector.

The demand for silver from the consumer electronics market is increasing, thanks to the increasingly massive use of artificial intelligence.

As regards investments, the expected increase amounts to +3%, driven by the growing demand from Europe and North America. However, a decline in demand for silver is expected in India, where high prices could encourage liquidations.

Most of the losses in the jewelry sector are expected to originate from India, with demand expected to decline by 6%.

More cautious spending by Chinese consumers should weaken demand for jewelery also in the Land of the Dragon. Conversely, the prices of branded karat gold and silver jewelry are expected to sustain consumption in Western countries.

Double-digit decline for the silverware sector, with the slowdown in Indian manufacturing which will cost a reduction in global demand of 16%.

Silver investments

The strengthening dollar and government bond yields have not discouraged investors from buying silver. Sentiment improved at the beginning of 2025, driven above all by macroeconomic and geopolitical risks that keep the focus on safe haven assets high.

The coverage of short positions by tactical investors in the futures market also contributed to facilitating the recovery, largely due to concerns about the tariffs imposed by the Trump government.

The uncertainty clouding the future of US foreign trade policy, the record stock markets and concerns about US public debt levels should encourage investors to diversify their portfolios, benefiting investments in physical silver.

Silver and mining production: what are the prospects?

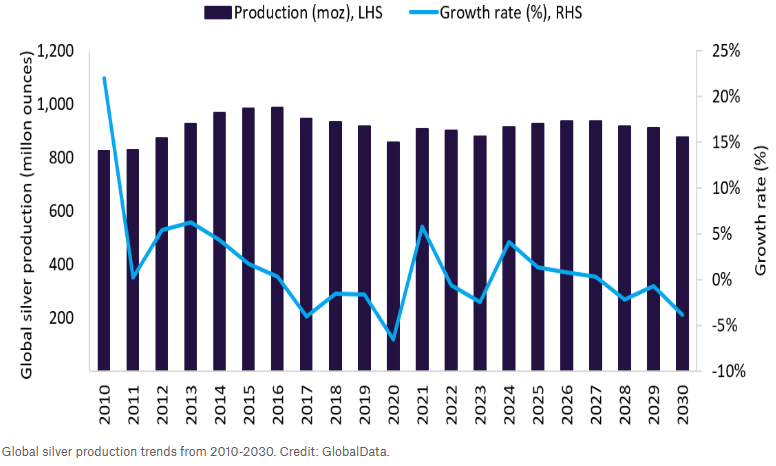

The start of new mining projects is expected to lead to an increase in silver production in 2025, pushing the global total to the highest levels since 2016. The Silver Institute expects total supply to rise 3% this year, reaching a peak of 1.05 billion ounces.

An increase destined to be short-lived, given that the depletion of reserves will exceed the mineral supply that the projects underway will be able to provide.

The extraction of silver as a by-product from gold mines is growing; in contrast, production from base metal mines is expected to remain stable.

Recycled silver

White metal recycling is expected to reach significant milestones in the coming years, particularly thanks to the jewelry and silverware sector. The latter in particular will enjoy the support of industrial scrap, facilitated by structural gains.

On the other hand, silver from the photographic industry is in decline, now the victim of a decline that is increasingly difficult to stop.

Fifth year of deficit

As anticipated, 2025 will mark the fifth consecutive year of silver market deficit. While growing mining production should temporarily buffer the situation, leading to market shortages decreasing by 19%, it still remains a complex, historically significant landscape.

Inventory reduction will be driven primarily by photovoltaic, artificial intelligence and inventory electrification.

Although silver is a metal known for "keeping its foot in both shoes", given its dual function as an industrial and investment metal, its dichotomy could prove to be a winning choice for investor portfolios.

Source:

IT

IT  ES

ES