Amid economic crises and record highs: an analysis and perspective on Gold's performance

Amid economic crises and record highs: an analysis and perspective on Gold's performance

On Tuesday, February 11, gold soared to $2,942.68 per ounce, marking a rise of over 46% compared to the same period last year. The historic record on Tuesday in euros per gram was €91.84, with a percentage increase of 54.6% compared to January 2024. But what are the reasons behind gold reaching these new historical peaks in such a short time frame? What impact do banking policies have? Why could the tariffs imposed by the Trump administration cause gold prices to skyrocket? And how might the implementation of Basel III reshuffle the gold market? Stay with us to find out!

Reasons and Consequences of Trump’s Tariffs

The most obvious motivations behind the rapid and significant rise in gold prices are geopolitical tensions and concerns about how inflation will react to the recent tariff battles. The latest rally was sparked by President Trump’s announcement on Sunday, February 9, that he intends to impose 25% tariffs on steel and aluminum imports. This move impacts the metal sector and fuels market fears, already strained by the 10% tariffs on Chinese goods and the proposed 25% tariffs on Mexican and Canadian imports, the latter currently delayed by 30 days.

One may wonder what the consequences of these tariffs might be and whether they will provide any benefits, even to the U.S. economy. At the moment, we can only hypothesize, but it is possible that Trump intends to renegotiate trade agreements with his counterparts through these tariffs, positioning the United States at an advantage. Another reason could be to stimulate domestic production, thereby boosting the labor market and benefiting GDP.

The risks associated with such protectionist policies are much more evident: not only retaliatory tariffs from countries hit by the measures but also the potential for a sharp rise in prices, inflating inflation, at least in the short term. Even more pronounced is the danger that import tariffs could slow economic growth, pushing buyers towards local businesses even if they are less efficient. The result would be a waste of resources for a more costly production than would otherwise have been the case. It is no surprise that investors, faced with a climate of increasing uncertainty, seek refuge in gold as a safe haven.

2024: Record Prices and Demand

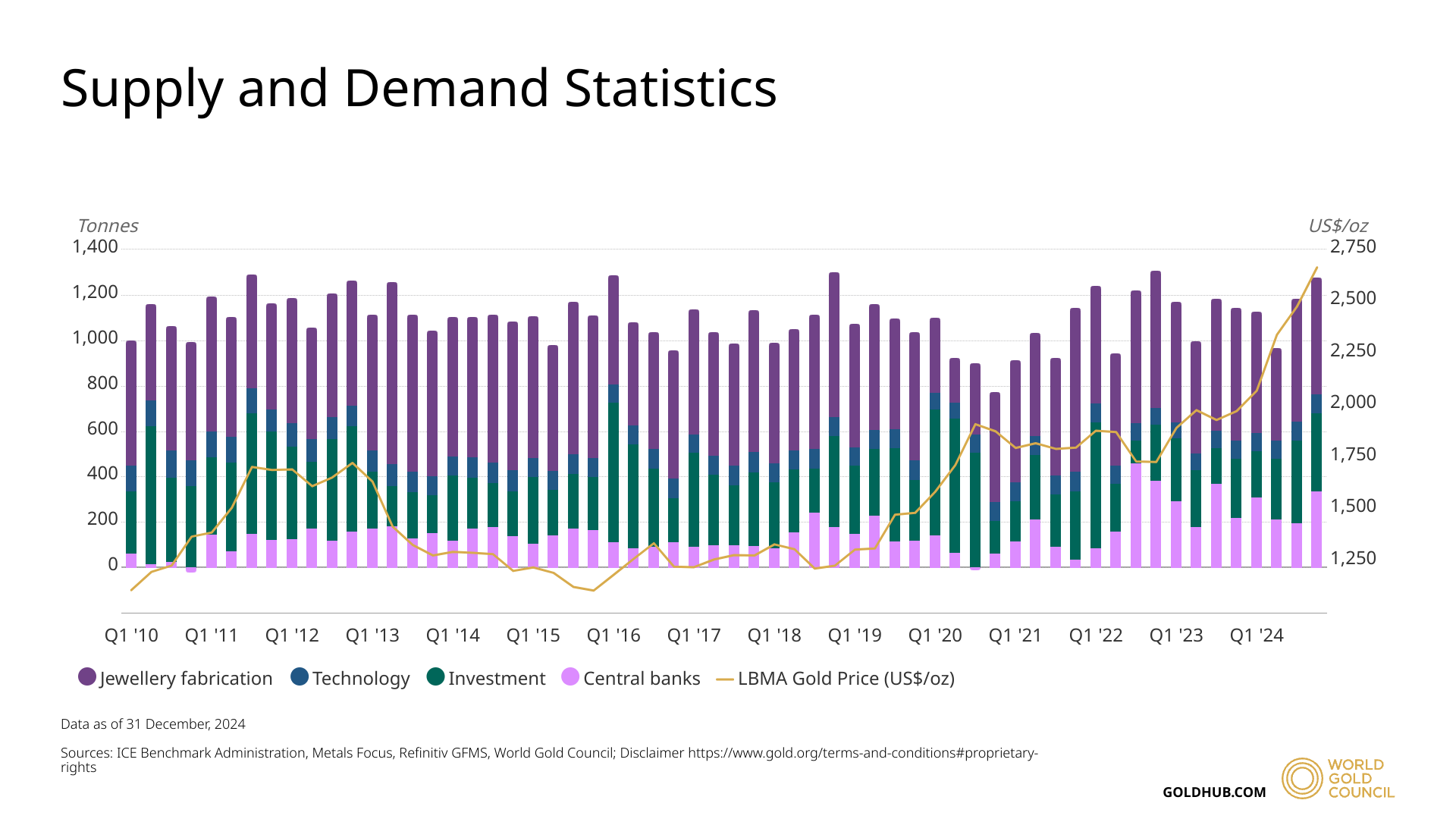

The World Gold Council’s report last year indicated a 1% increase in global physical gold demand compared to 2023, reaching a historic peak of 4,974 metric tonnes. The combination of gold prices and record volumes led demand to its highest value ever: $382 billion.

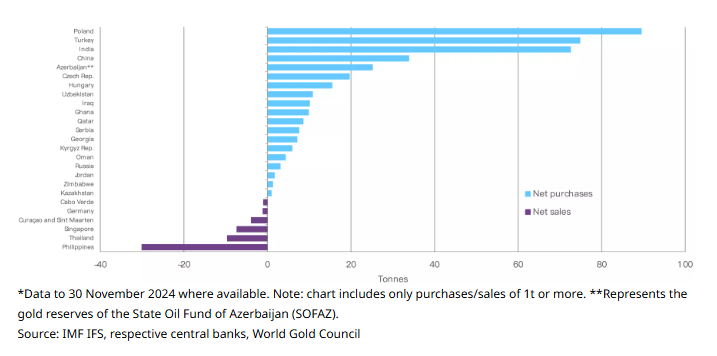

Central bank purchases, which exceeded 1,000 tonnes for the third consecutive year, played a key role in supporting gold prices in 2024. The peak in central bank purchases occurred in the fourth quarter, when total annual reserves reached 1,045 tonnes. Leading buyers include the National Bank of Poland, which added 90 tonnes to its reserves; the Central Bank of Turkey (75 tonnes); the Reserve Bank of India (77 tonnes); and the People's Bank of China (about 30 tonnes).

The rise in the cost of the raw material has predictably slowed demand from the jewelry sector, which fell 11% to a total of 1,877 tonnes in 2024. This decline was largely due to weakness in China, where demand plummeted by 24% year-on-year; however, India showed some resilience, dropping by only 2% despite record prices. On the other hand, the technology sector showed excellent results, with demand increasing by 7% compared to 2023, reaching a total of 326 tonnes, driven by gold usage in electronics and artificial intelligence.

Gold investment purchases also increased in 2024, reaching a four-year high of 1,180 tonnes, a 25% increase from 2023. Despite the appreciation of the dollar, demand for gold remained robust, driven by economic and political uncertainties and growing pressure on markets.

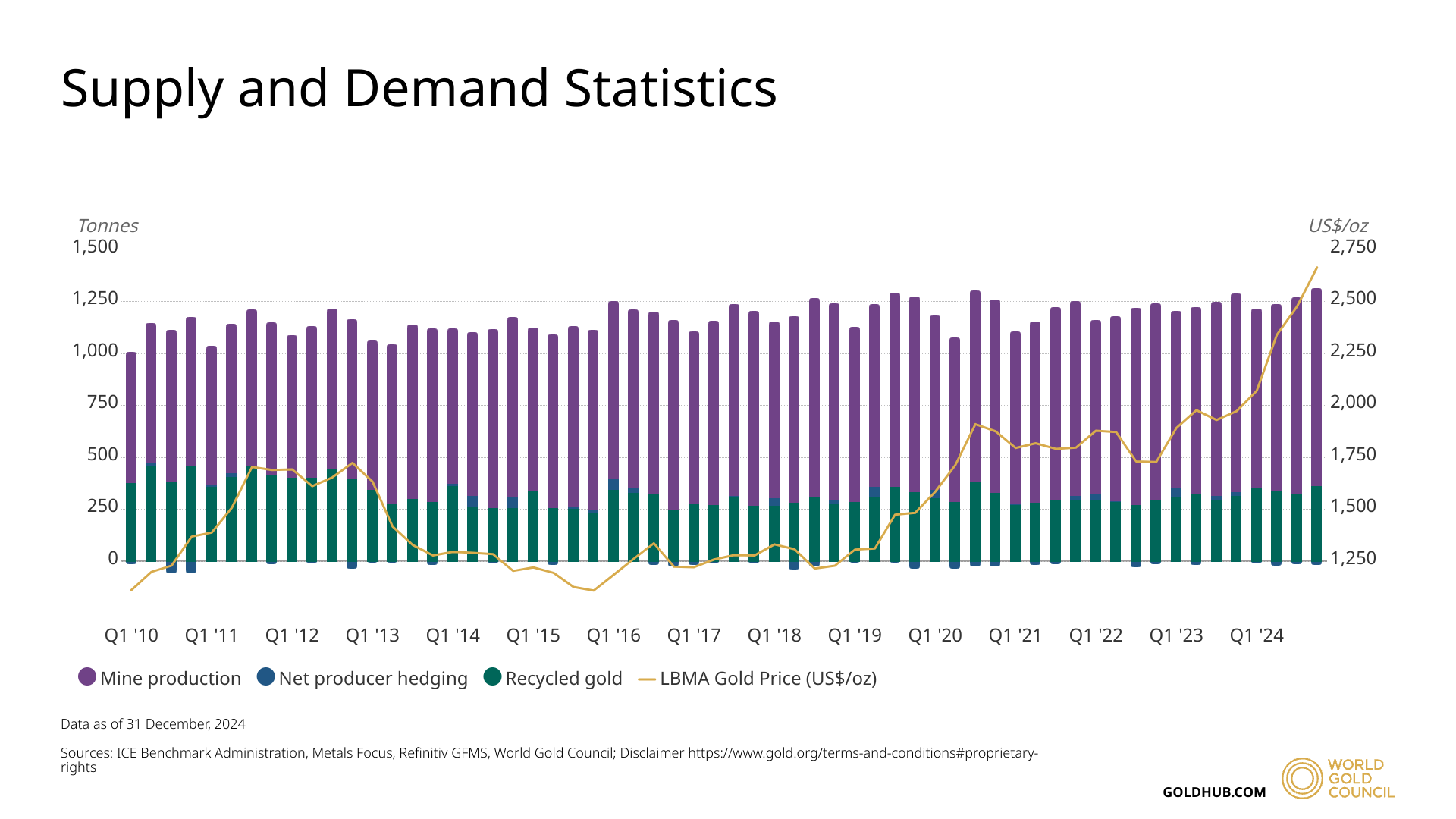

Gold output remained largely stable since 2016, although there was a 4% increase in the first quarter of 2024 compared to the previous year. China holds the top position among gold-producing countries, with a total of 330 tonnes. It is followed by Russia (320 tonnes) and Australia (315 tonnes).

New Records in Speculative Gold

Speculative gold prices reached new records in 2024, with prices nearing $3,000 per ounce ($93.46 per gram).

Uncertainties for the Future: BRICS and London’s Struggles

Staying on the topic of speculative gold, it is estimated that there are currently 133 ounces of paper gold for every ounce of physical gold—a discrepancy that raises several concerns, foremost being the risk of a future rush on the physical commodity. Such a scenario could cause the price of physical gold to skyrocket, while the value of paper gold would likely collapse, leading to a market shock.

The financial market’s growth remains stable in the new year, supported by the uncertainty surrounding the BRICS countries (Brazil, Russia, India, China, South Africa, and recently Egypt, UAE, Ethiopia, Iran, and Indonesia). Western markets are fearful that this alliance could introduce an alternative gold-backed currency, undermining the dollar’s hegemony. The greenback currently serves as the reference currency for international trade, and Trump is keen to ensure it remains so. At the end of January, the president threatened to impose 100% tariffs on BRICS countries if they supported an alternative currency to the dollar.

The gold market has also been shaken by the recent transfer of large amounts of precious metal to New York vaults. Fears that Trump’s tariffs could target raw materials, including gold, have prompted giants such as Comex and JPMorgan Chase & Co to recall reserves held in London vaults. The gold in Comex deposits now totals 926 tonnes, the highest level since August 2022, marking a 75% increase.

This is a difficult situation for London, the main gold market, which has seen the waiting time for withdrawing reserves from vaults increase dramatically, from a few days to the current 4-8 weeks. The interbank interest rate for gold loans has also risen for 1-3 month terms: it typically does not exceed 0.5%, but recently it has soared to 12%.

Basel III: Financial Gold at Risk?

With the implementation of Basel III, the impact of the Net Stable Funding Ratio (NSFR) on the gold market is being assessed. According to current regulations, the cost for banks holding gold on their balance sheets will rise, as the NSFR requires 85% of material assets as collateral.

This approach increases the cost of financial gold in favor of physical gold, which Basel III defines as “zero-risk” for banks—on par with cash. This means banks can hold physical gold without it being considered a risky investment, benefiting the strategic value of the yellow metal. The new rules also reduce the weight of the so-called "paper gold" market (ETFs, futures contracts), which has artificially kept the price of physical gold low. This is expected to increase the value of physical gold over time, as well as incentivize banks to hold the precious metal as a reserve. Companies and investors are also more likely to buy physical gold rather than financial instruments linked to paper gold.

In conclusion, recent developments highlight the liquidity issue for physical gold deliveries, especially if demand is concentrated in a short period of time. This scenario could mark the beginning of a controlled easing of the price management system, still a subject of debate today. The rate for short positions on gold on platforms is currently 3.6%, but it is subject to strong fluctuations.

On January 2, 2025, Italpreziosi received 2.8%, only to drop to 0.55% on January 14. The volatility of rates remains high (even exceeding 11% at times) due to fluctuations in gold prices and global economic factors. A similar situation exists for silver, though less aggressive: the rate went from 0.4% in late January to more than 6% during the first week of February. On Tuesday, February 11, the rate stood at 3.6%.

Sources:

IT

IT  ES

ES